In the business world, managing cash flow is a crucial factor for the success and continued growth of a business. One of the key indicators that companies use to measure the efficiency of their accounts receivable management and understand its impact on cash flow is “Days Sales Outstanding” (DSO). In this blog we take a closer look at what DSO means, how to calculate it, and what impact it has on your cash flow position.

What is Days Sales Outstanding (DSO)?

DSO is a measure that indicates how long on average it takes for a company to collect its outstanding invoices. It tells us how many days it takes for the company to convert its sales into cash. In short, it measures the efficiency of a company’s accounts receivable management. Or put another way… how long a company plays bank for its customers and actually pre-finances all costs incurred in this way.

The Impact of DSO on Cash Flow Position

A shorter DSO indicates a faster conversion of sales into cash, which is beneficial to a company’s cash flow. A longer DSO, on the other hand, means more time passes between the time of sale and the time the cash is received, which can lead to liquidity problems.

Imagine you have a company that sells products with a 30-day payment term, but your DSO is 45 days. This means that you have to wait an average of 45 days before receiving payment, even though you have already incurred costs to produce those products. This can lead to a situation where you struggle to pay bills or invest in growing businesses simply because your cash is tied up in outstanding invoices. In the worst case, you will also get into trouble with your suppliers by paying their invoices much too late.

So keeping your DSO tight is really a crucial health indicator of your company.

How do you calculate DSO?

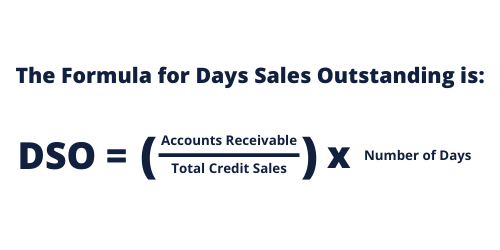

The formula for calculating DSO is quite simple:

Whereby:

Outstanding debtors (Accounts Receivable): the total amount of outstanding invoices at a certain time (e.g. end of month)

Total monthly turnover (or total Credit Sales): the total amount of credit sales during the same period/month.

Number of days: the period over which you calculate the DSO.

A concrete example:

For example, let’s say that your company currently (last month) has €25,000 in outstanding invoices and that your total (credit) sales (= payment on invoice) during that same month were €15,000. If we wanted to calculate the DSO for the last month, which has 30 days, the calculation would look like this:

DSO = (25,000 outstanding payments / 15,000 turnover on invoice) × 30 = 50

This means that it takes an average of 50 days for your company to collect its outstanding invoices. In itself, this number says little, but when you compare it with your invoice conditions you will gain a better insight into how healthy your company is in terms of cash flow.

If your invoice conditions are “payment 30 days after the invoice date” and your DSO is equal to 50, this means that your customers pay on average 20 days late. You essentially play for the bank for 20 days.

Conclusion:

Managing DSO is vital to managing your cash flow position. By reducing DSO, companies can improve their cash flow, giving them more financial flexibility and better investment in growth. Monitoring DSO and taking measures to reduce it, such as improving accounts receivable management processes or adjusting payment terms, can therefore bring significant benefits to companies of all sizes.

I challenge every entrepreneur to calculate the DSO of the past months or even the past year… a real “eye opener”

If you would like to know more about how to implement healthy cash flow management in your company and how you can keep your DSO as small as possible by applying strict accounts receivable management, request a free strategy session below.